"US rejects 'living wills' of 5 banks," from FT. WSJ puts this event in the larger story of Dodd Frank unraveling. Juicy quotes:

WSJ: “living wills,” ... are supposed to show in detail how these banking titans, in the event of failure, could be placed into bankruptcy without wrecking the financial system.It seems like a good moment to revisit an idea buried deep in "Toward a run-free financial system." How could we structure banks to fail transparently?

FT:...the shortcomings varied by bank but included flawed computer models; inadequate estimates of liquidity needs; questionable assumptions about the capital required to be wound up; and unacceptable judgments on when to enter banktruptcy.

FT: David Hirschmann of the US Chamber of Commerce, the biggest business lobby, said the living wills process was “broken”. “When you can’t comply no matter how much money you put into legitimately trying to comply, maybe it’s time to ask: did we get the test wrong?” he said.

WSJ: Six years after the law was passed, and eight years since the financial crisis, regulators given broad authority to remake American finance, with thousands of regulatory officials on their payroll, cannot figure out a system to allow financial giants to fail, even in theory. What are we paying these people for?

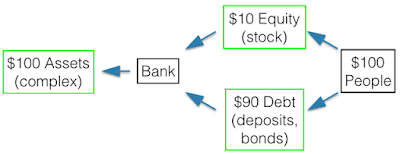

Recall, here is how banks are structured now (extremely simplified). Banks hold assets like loans, mortgages and securities. Banks get money to fund these assets by selling a tiny amount of equity, i.e. stock, and by a huge amount of borrowing, including deposits, long-term bonds, and short-term debt.

The trouble with this system is, if the value of the assets falls by more than $10 in my example, the equity is wiped out, and the bank can't pay its debts. If short-term debt holders worry about this event, they all clamor to get paid first, so a run can happen. That's not really a problem either; bankruptcy is set up exactly to handle this situation. The creditors who lent money to the bank split up the assets. Yes, they don't get their full money back, but if you lend to a bank that's leveraged like this, that's the risk you take.

The trouble is the widespread feeling that big banks are too big, too complex, too illiquid, to utterly muddy, to carve up this way. If it takes years in court, and if all the value of the assets is drained away by lawyers, you have a real problem. Furthermore, we often want the profitable parts of the bank to remain in operation while the creditors squabble about assets. (Ben Bernanke's classic paper on banking in the great depression makes this point beautifully.) The ATM machines should not go dark, the offices where people know their customers and can keep things going should stay in operation.

Hence, big banks become too big -- or too something -- to fail. In that situation, the government is mighty tempted to bail out the creditors and keep the thing limping along. Given that temptation, a lot of large, politically well connected creditors also scream that there will be ``systemic dangers'' if they don't get their cash now, adding to the bailout pressure. A "living will" is supposed to stop this chain, by allowing bank assets to very quickly get divvied up among creditors.

But the large banks are, apparently, so large and complex that nobody can figure out a living will. That's debateable, for example Kenneth Scott and John Taylor argue bankruptcy can work. But let's go with the idea. Is there an alternative to Bernie Sanders' bust up the banks? Here's one.

Starting from the left, suppose the bank holds all the same assets it does today. But, it issues 100% equity to finance its assets. Now, a 100% equity financed bank cannot fail. If you don't have any debt, you can't fail to pay debts. Yes, the bank can lose money and slowly go out of business. But it cannot go bankrupt. As it loses money, the value of its equity declines, until shareholders get mad and liquidate the carcass. Nobody can run to get their money out ahead of the other person. End of bankruptcy, end of bank runs, end of financial crises.

(Technical note. Yes, that's a bit overstated. A bank can potentially invest in derivatives and other securities where it can lose more than all of the investment. The amount of monitoring needed to make sure this doesn't happen is trivial next to the Basel sort of thing required to make sure a bank never loses more than a few percent of its value.)

OK, gulp, you say. But don't people "need" to have bank accounts? Isn't "transformation" of debt into loans the crucial feature of the financial system? Don't equity holders "require" high risk, high-return stock? No, argues the "run-free financial system" essay. But let's not go there. Let's just restructure things so that the bank can hold exactly the same assets it has today, and its investors can hold exactly the same assets they hold today.

So, moving to the right in my little picture, suppose bank stock is held in a mutual fund, exchange traded fund, or a special-purpose "bank." Bank stock is the only asset these companies hold, and that stock is also traded on exchanges. These banks fund themselves by the same mix of debt, equity, deposits, and heck even overnight wholesale debt, commercial paper, and so forth.

Now, if the value of the bank stock falls, these holding companies fail, just as my original bank failed. But there is a huge difference. You can resolve the holding company in a morning and still make it to play golf in the afternoon. The only asset is common stock, commonly traded! There are no derivatives positions to unwind, no strange positions in offshore investment trusts, or whatever. The "living will" simply specifies how much common equity each debtholder gets in the event of bankruptcy. There is never any need to break up, liquidate, assess, or transfer bits and pieces of the big bank.

Furthermore, there is no more obscurity over the value of the holding company assets. We see the value of bank assets, marked to market, on a millisecond basis.

The holding companies can provide all the retail deposit services banks now provide. In fact, they could contract out to the banks to provide those on a fee basis, so the customer might not even need to know.

In addition, any sane holding company would hold the stock of several banks, diversifying the risk, and thus reducing the chances of ever needing to be wound up. Come to think of it, any sane holding company would also diversify out of banking, but now we're back to my larger vision of equity-financed banking and sensible small changes in financial structure to achieve it.

In the meantime, there you have it. 100% equity financed banks can still give bank creditors exactly the same assets they hold today, and allow failures of those debts to be resolved in a morning.

Không có nhận xét nào:

Đăng nhận xét